For many businesses and financial departments, there are major challenges to overcome when financial reporting periods come around. Reviewing your business finances on a regular basis is essential to successfully plan your future financials. The problem is knowing where and when to start, and how to make the whole process more efficient.

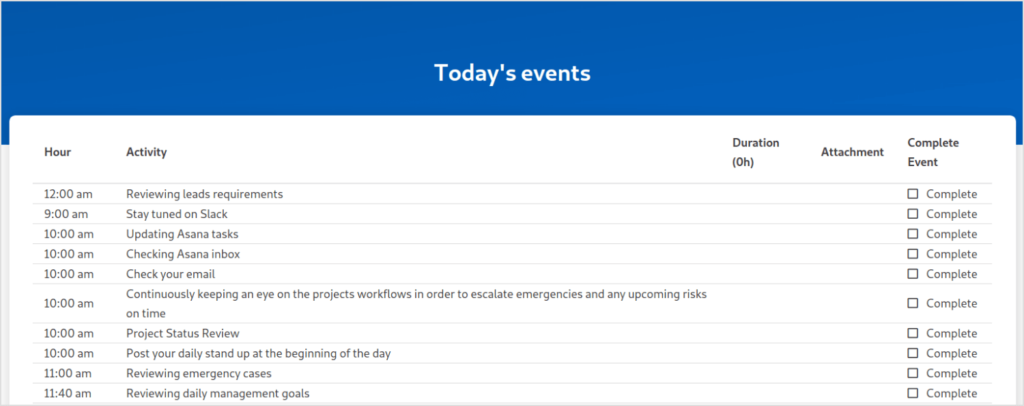

Preparing quarterly financial reviews and reporting includes many arduous tasks such as checking balance sheets, cash flow statements, and other key financial documents. Depending on the business that you are in, you may need to focus on a myriad of other factors and data points that are crucial parts of your organization. Doing quarterly financial reviews can help you keep track of your incoming and outgoing money, as well as your business goals.

The more info you need to include in your review, the more complex reporting becomes. That’s why we’re covering how to make a quarterly report in more detail. This is how to manage quarterly financial reviews and reporting the right way:

The Basics of Financial Reviews

A financial review or quarterly report is a collection of financial statements that have not been audited yet. Usually, these reports involve looking at documents like income statements, balance sheets, cash flow statements, and others issued in the past three months. Apart from these quarterly figures, financial reviews can also include comparisons to statements from previous years. Collecting all of this information will help you see if your business is operating within your means – especially when it comes to finances going out.

When do companies typically report quarterly earnings? The answer is that it will depend on the type of business you have. The majority of companies have set accounting periods that end on specific dates in the financial year, and this is when they do their financial reviews. Usually, the quarterly dates are at the end of March, June, September, or December. Some industries, however, follow different financial calendars and their year-end figures are reported at different times. It’s best to research what the standard practice is for your industry.

The Challenges of Financial Reviews

As important as quarterly financial reviews are, they can also be challenging to conduct.

One of the biggest challenges is that financial reviews are slow and complicated to compile. Finding all the relevant data, and then putting it into a concise report is often easier said than done. Financial reviews are often viewed not only internally by the rest of your business team, but can also be put forward to stakeholders and potential investors. If there is something missing or incorrect in your report, you can bet that questions will come up from these individuals.

It’s a lot of pressure – all the included information has to be 100% correct and needs to be triple-checked, slowing down the process even further. Other challenges that add additional pressure are having to comply with requirements set by the local government. These requirements are also ever-changing, causing further delays as financial departments work to comply. Every quarter can be different from the last as a result.

What Must Be Included

While the exact documents included in financial reviews can vary between companies and industries, there are some common features that come up in many. Most quarterly reports have executive summaries, goals, objectives, comparisons, and challenges listed, interspersed with the latest financial data available for the business. Sections on challenges may include strategies that can be employed to overcome them. For example, if your financials are down in this quarter compared to last, you can add strategies that you can use to improve them such as putting more time into marketing.

Many quarterly reports include data from previous quarterly reports in order to show year-on-year comparisons. This aspect becomes particularly important when approaching stakeholders or potential investors. Financial reports are typically data-heavy – many financial reviews are filled with graphs and spreadsheets which further illustrate the performance of your business.

How To Manage Quarterly Financial Reviews

As mentioned above, once a report has been created and delivered to the relevant parties, you can put money on the fact that questions will follow, such as “How did we get this number?”

With experience, you will learn how to anticipate these questions and include them in your report from the get-go, leading to fewer follow-up questions in the future and a more comprehensive report. Some business process management tools have built-in features that can be used to do reporting and analysis on factors like recent trends and variance compared to the previous quarters.

Remember for future projections, versioning will be critical. When doing future projections for your business, you should do a version which has conservative predictions (such as the market being down), a version that is in the middle (a market performing as per usual) and an aggressive prediction (markets performing positively above and beyond the expected). This makes your report more comprehensive and gives key stakeholders a better idea of how you plan to target the next quarter.

Often, companies will also include estimates of their key metrics for future reporting periods and use them as a goal to reach and even exceed. This goes well with the projections made as previously mentioned.

While there is some variation in how companies handle quarterly financial reviews, there are also lots of features that are common, such as comparing previous financials, projecting future ones, and strategizing for current market conditions. Preparing a quarterly earnings report is a slow and effort-intensive process that requires a lot of preparation, but using the right tools, the process can become much faster and easier to complete.

At the end of the day, you don’t want preparing for this report to affect your overall productivity. Quarterly financial reviews need to be completely accurate which adds a lot of pressure. With some experience, creating a report of this nature will become less intensive to conduct and instead become a process that is simply advantageous for your business. Contact us for further information.